On the Horizon: Relocation Impacts of Institutional Buying in the U.S.

While institutional buying in residential real estate is nothing new, the United States has experienced a significant uptick in activity over the last two years. For many sellers, the increase in competition for available homes has been welcome, creating a favorable windfall in equity gains; however, in stark contrast, sellers often become buyers in similarly challenging real estate climates and encounter complications with lack of inventory, bidding wars or offers that simply can’t compete with institutional buyer cash offers carrying little or no contingencies.

What is “Institutional Buying”?

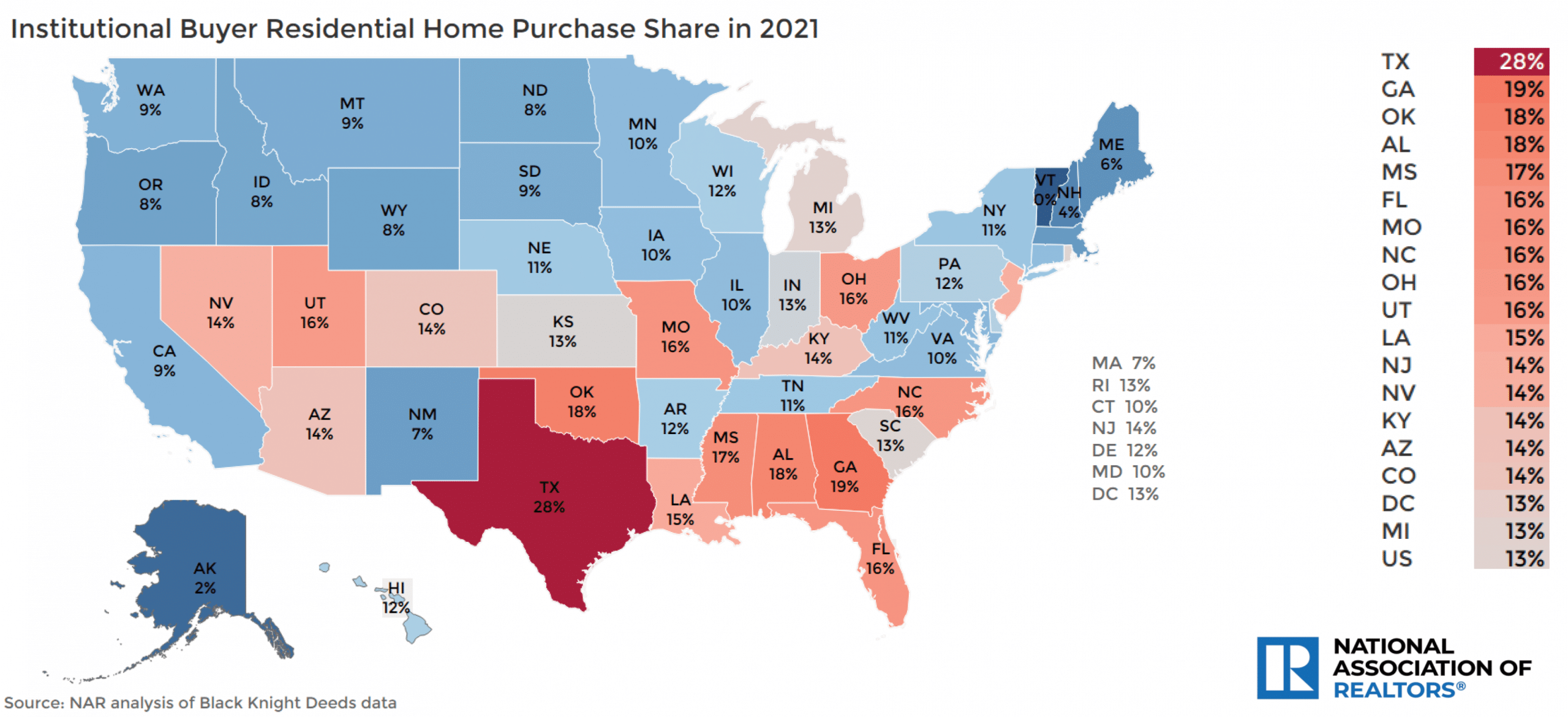

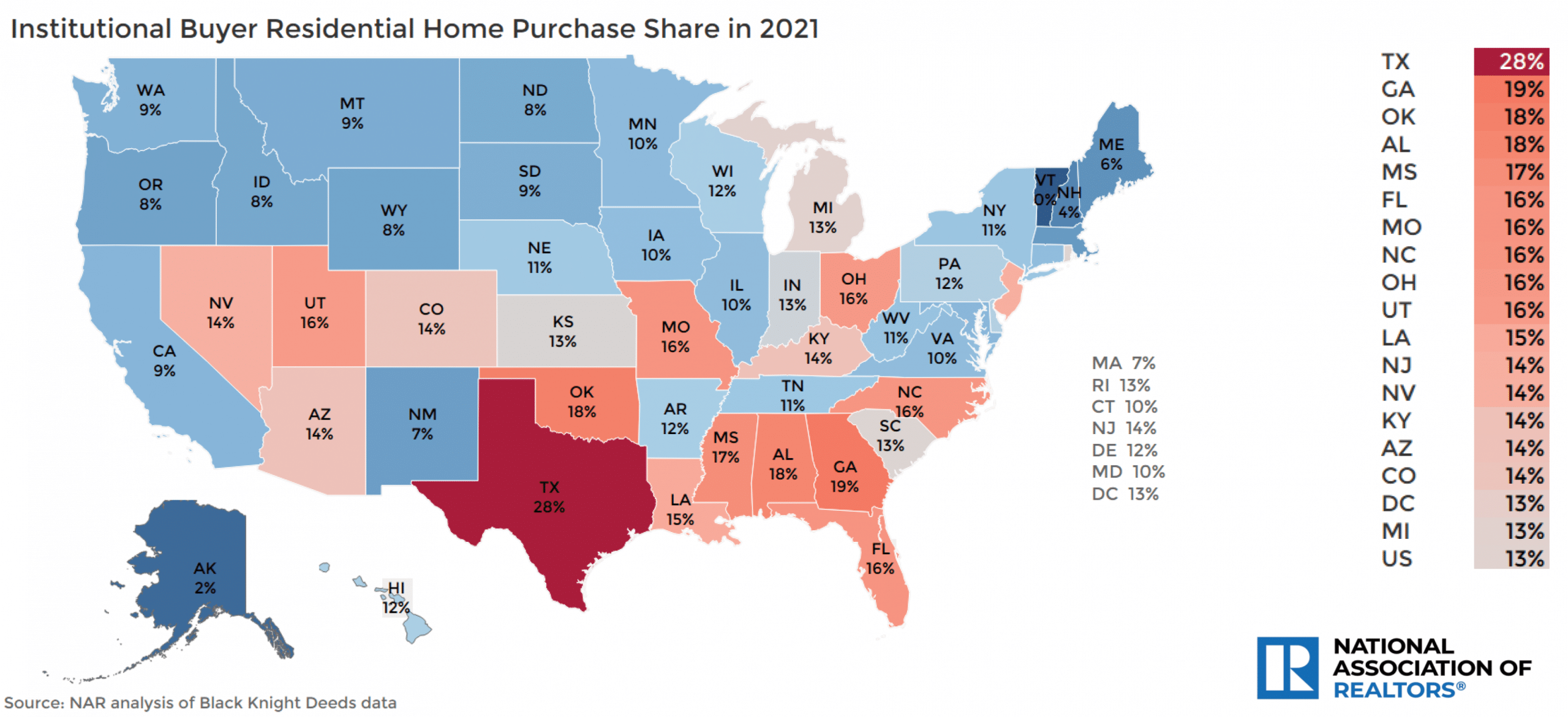

Institutional buying refers to the purchase of residential real estate by companies, corporations or LLCs. According to the National Association of Realtors (NAR), institutional buyers accounted for 15% of all residential real estate purchases in the U.S. in 2021. The locations with the highest percentage institutional buyer market share were:

- Texas (28%)

- Georgia (19%)

- Oklahoma & Alabama (18%)

- Mississippi (17%)

- Florida, Missouri, North Carolina, Ohio and Utah (all at 16%)

Similarly, many of these locations align with the highest U.S. domestic relocation traffic Altair saw for the same timeframe. The top areas of U.S. domestic relocation traffic in 2021 for Altair were:

- Texas*

- California

- Georgia*

- New Jersey, Florida* and Illinois (all fairly even)

- North Carolina*

*Denotes locations of highest Altair relocation activity that intersect with the top 5 states for institutional buying

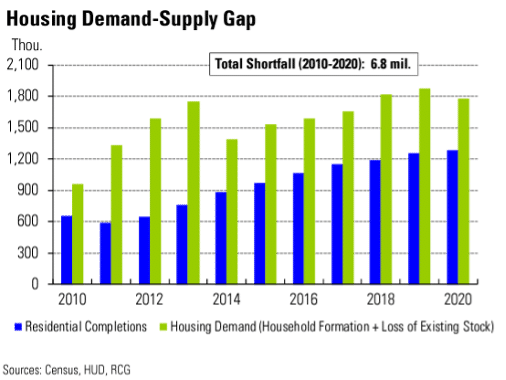

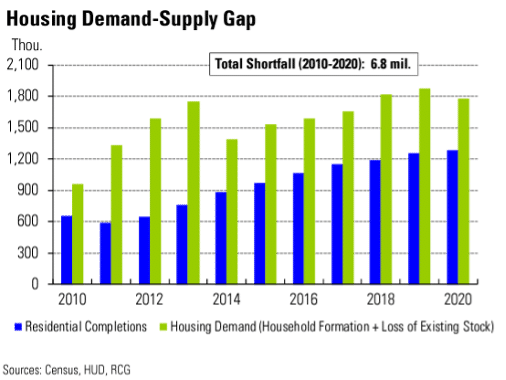

The shortage of available homes is underpinned by a long-term deficit in new construction spanning the last 20 years. Rosen Consulting Group (RCG) reports from 1968 to 2000, the U.S. housing stock grew at an annual average of 1.7%; however, post-2000 that number dropped to 1%. The result of this is an estimated construction deficit of more than 5.5 million units. In addition, demand for housing has also continued to increase, further widening the gap between supply and demand. As the chart below demonstrates, the U.S. is facing a 6.8 million-unit gap in housing needed to meet current demand.

What This Means for Mobility

Many in mobility have already begun experiencing the impacts of these challenges to relocating employees. For the past 18 – 24 months, there has been considerable feedback regarding the realities of lack of inventory, having to put offers in on multiple homes (sometimes sight unseen), and even offering well above asking price only to find out the accepted offer was significantly higher still.

The issue extends beyond homeowners, as the shortage in available units has created a burden on rental markets, as well. Many would-be homeowners are being forced into rentals – both short-term and long-term – as a way to manage the reality of being a buyer in a seller’s market. NAR’s research demonstrates a correlation in investment buying and vacancy rates. When looking at areas where institutional buying is above the national average of 15%, vacancy rates are at 15.7% (but dips as low as 4% in some areas); whereas vacancies average 16.7% in areas where institutional buying occurs below the national average.

The result, as many mobility managers have seen, is an increase to exceptions resulting from delays in finding permanent housing. These most prominent exceptions are:

- Additional time in temporary living

- Additional temporary storage of household goods

- Extensions to benefits to allow relocation employees additional time to house hunt or continue house hunting after a period of renting

Strategies for Managing

While there is not specific trending with regard to policy changes or trending responses to these issues, the best approach is to create a strategy now for how the organization will address these situations as they arise. A few situations and recommendations to consider:

- Temporary living extension requests may be tempered with employees’ specific situations. For example, where an employee may have realized large equity gains from their home sale and then has a need for additional temporary living prior to home purchase, temporary living expenses would be far less of a financial burden to the employee. Companies may consider sharing in the added cost of extensions versus assuming the entire cost.

- Extensions to utilize benefits are less complicated, as there is no added program cost, but may add layers of complications in cost accruals and crossing additional tax years. In these scenarios, we see far more leniency in approving exceptions to extend, provided the employee can demonstrate a good faith effort to locate permanent housing.

- Incentives to rent are not new in relocation, but this a great time to review if the addition is the right fit for a program. While these provisions have been traditionally utilized to address high costs involved with home sales and purchases in specific locations, a more broad-based approach would be recommended at this time. Under incent to rent programs, employees are often provided the ability to “port” their purchase benefits to their next relocation (provided they were eligible for purchase benefits in their current relocation), and, in some cases an incentive is offered if forgoing a purchase.

As with any trending issues, Altair does not typically recommend making permanent program changes to account for what may result in short-term concerns. There are several options to consider such as establishing internal processes to review specific issues of a temporary nature, implementing addendums with clear start and end dates (extended as necessary) and then, finally, implementing changes to policy for temporary solutions the organization is prepared to adopt as part of the long-term mobility program.

Altair’s Client Services Team Members are available to discuss options and how Altair can best provide support.

About Global Consulting Services:

One size doesn’t fit all when it comes to our Client Partners’ programs, policies and cultures. In order to deliver an unmatched mobility experience, we provide expert recommendations and insights to build and strengthen our clients’ benefit offerings to meet their overall business and talent mobility objectives for the future. Working with more than 100 companies each year, Altair’s Global Consulting Services team takes a holistic approach to mobility by arming clients with first-rate data, research and trend information to find the best relocation and mobility solutions for your employees, your mobility program and your company.

Share This Story, Choose Your Platform!

While institutional buying in residential real estate is nothing new, the United States has experienced a significant uptick in activity over the last two years. For many sellers, the increase in competition for available homes has been welcome, creating a favorable windfall in equity gains; however, in stark contrast, sellers often become buyers in similarly challenging real estate climates and encounter complications with lack of inventory, bidding wars or offers that simply can’t compete with institutional buyer cash offers carrying little or no contingencies.

What is “Institutional Buying”?

Institutional buying refers to the purchase of residential real estate by companies, corporations or LLCs. According to the National Association of Realtors (NAR), institutional buyers accounted for 15% of all residential real estate purchases in the U.S. in 2021. The locations with the highest percentage institutional buyer market share were:

- Texas (28%)

- Georgia (19%)

- Oklahoma & Alabama (18%)

- Mississippi (17%)

- Florida, Missouri, North Carolina, Ohio and Utah (all at 16%)

Similarly, many of these locations align with the highest U.S. domestic relocation traffic Altair saw for the same timeframe. The top areas of U.S. domestic relocation traffic in 2021 for Altair were:

- Texas*

- California

- Georgia*

- New Jersey, Florida* and Illinois (all fairly even)

- North Carolina*

*Denotes locations of highest Altair relocation activity that intersect with the top 5 states for institutional buying

The shortage of available homes is underpinned by a long-term deficit in new construction spanning the last 20 years. Rosen Consulting Group (RCG) reports from 1968 to 2000, the U.S. housing stock grew at an annual average of 1.7%; however, post-2000 that number dropped to 1%. The result of this is an estimated construction deficit of more than 5.5 million units. In addition, demand for housing has also continued to increase, further widening the gap between supply and demand. As the chart below demonstrates, the U.S. is facing a 6.8 million-unit gap in housing needed to meet current demand.

What This Means for Mobility

Many in mobility have already begun experiencing the impacts of these challenges to relocating employees. For the past 18 – 24 months, there has been considerable feedback regarding the realities of lack of inventory, having to put offers in on multiple homes (sometimes sight unseen), and even offering well above asking price only to find out the accepted offer was significantly higher still.

The issue extends beyond homeowners, as the shortage in available units has created a burden on rental markets, as well. Many would-be homeowners are being forced into rentals – both short-term and long-term – as a way to manage the reality of being a buyer in a seller’s market. NAR’s research demonstrates a correlation in investment buying and vacancy rates. When looking at areas where institutional buying is above the national average of 15%, vacancy rates are at 15.7% (but dips as low as 4% in some areas); whereas vacancies average 16.7% in areas where institutional buying occurs below the national average.

The result, as many mobility managers have seen, is an increase to exceptions resulting from delays in finding permanent housing. These most prominent exceptions are:

- Additional time in temporary living

- Additional temporary storage of household goods

- Extensions to benefits to allow relocation employees additional time to house hunt or continue house hunting after a period of renting

Strategies for Managing

While there is not specific trending with regard to policy changes or trending responses to these issues, the best approach is to create a strategy now for how the organization will address these situations as they arise. A few situations and recommendations to consider:

- Temporary living extension requests may be tempered with employees’ specific situations. For example, where an employee may have realized large equity gains from their home sale and then has a need for additional temporary living prior to home purchase, temporary living expenses would be far less of a financial burden to the employee. Companies may consider sharing in the added cost of extensions versus assuming the entire cost.

- Extensions to utilize benefits are less complicated, as there is no added program cost, but may add layers of complications in cost accruals and crossing additional tax years. In these scenarios, we see far more leniency in approving exceptions to extend, provided the employee can demonstrate a good faith effort to locate permanent housing.

- Incentives to rent are not new in relocation, but this a great time to review if the addition is the right fit for a program. While these provisions have been traditionally utilized to address high costs involved with home sales and purchases in specific locations, a more broad-based approach would be recommended at this time. Under incent to rent programs, employees are often provided the ability to “port” their purchase benefits to their next relocation (provided they were eligible for purchase benefits in their current relocation), and, in some cases an incentive is offered if forgoing a purchase.

As with any trending issues, Altair does not typically recommend making permanent program changes to account for what may result in short-term concerns. There are several options to consider such as establishing internal processes to review specific issues of a temporary nature, implementing addendums with clear start and end dates (extended as necessary) and then, finally, implementing changes to policy for temporary solutions the organization is prepared to adopt as part of the long-term mobility program.

Altair’s Client Services Team Members are available to discuss options and how Altair can best provide support.

About Global Consulting Services:

One size doesn’t fit all when it comes to our Client Partners’ programs, policies and cultures. In order to deliver an unmatched mobility experience, we provide expert recommendations and insights to build and strengthen our clients’ benefit offerings to meet their overall business and talent mobility objectives for the future. Working with more than 100 companies each year, Altair’s Global Consulting Services team takes a holistic approach to mobility by arming clients with first-rate data, research and trend information to find the best relocation and mobility solutions for your employees, your mobility program and your company.