The Silicon Valley Bank Collapse — What Does It Mean for Corporate Relocation Practices?

It’s likely that you’ve heard about the Silicon Valley Bank (SVB) collapse at this point, but how does this affect the corporate relocation industry going forward? Altair Global’s George Powdar, Senior Vice President of Global Reporting & Compliance, advises below.

Catch Me Up: What Exactly Happened?

Here’s a brief recap: for those unfamiliar with SVB, the major financial institution specializes in providing banking and financing services primarily to technology and life science companies. As a result, it became a go-to institution for startups and established tech companies alike.

However, as we’ve seen lately with the wave of layoffs and company reorgs, the tech industry is currently experiencing a downward shift on the tail-end of the COVID-19 pandemic.

On Friday, March 10, the bank—which had grown to be the 16th largest in America—collapsed, creating the second-largest bank failure in U.S. history, after the Washington Mutual Bank collapse of 2008. How, you may ask? The institution had invested its funds in long-term bonds while rates were significantly lowered. As those interest rates rose, the long-term bond prices fell, forcing SVB to announce an after-tax loss of $1.8 billion in the first quarter of 2023.

The market reacted swiftly and sharply soon after the announcement, as SVB lost over $160 billion in value within 24 hours of the announcement. Depositors reacted to the plummeting stocks by withdrawing money from the bank, emptying the institution’s fractional reserve and rendering them unable to give all depositors their money in hand.

With the large bank being unable to provide the cash to depositors, the Federal Deposit Insurance Corporation (FDIC) took over SVB to help mediate the situation, which was now at a dangerous risk to the U.S. financial system.

What Does This Mean for Businesses and the Relocation Industry?

The collapse of SVB caused a ripple effect across the American financial industry, which soon saw other bank depositors at separate institutions withdrawing cash, including Signature Bank in New York, which closed on Sunday, March 12.

The upset and instability of several banking institutions worldwide have led many organizations to change their banking relationships, leading to an unusually large volume of communication about banking information between organizations and their customers, vendors and partners.

Protect Yourself From Potential Cyberattacks

Any communication about sending or receiving payments carries risk claims for fraudulent funds transfers (FFTs), which are already the most frequent type experienced by most customers. Since threat actors know that many organizations will be sending and receiving requests to change payment instructions, they will be poised to take advantage.

In fact, our cybersecurity insurance company has observed a large number of new website domain registrations with names that mimic bank login pages for use in phishing campaigns.

What You Can Do

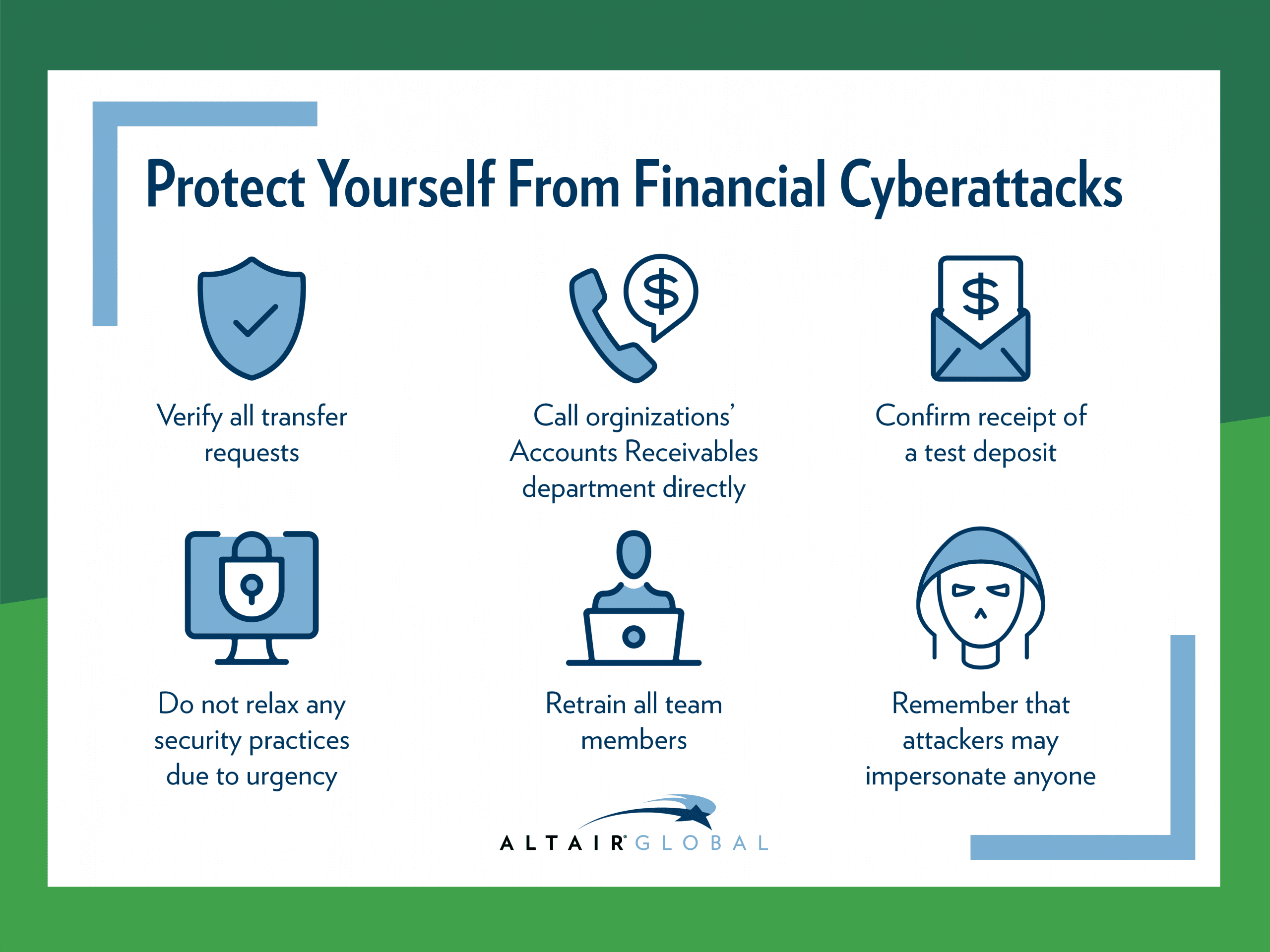

We encourage all companies and employees worldwide to take the following steps to mitigate potential attacks:

- Verify all requests to transfer payments or update payment information by calling a known phone number and speaking to the customer or supplier (a known voice).

- If you do not have a contact at the organization in question, go to the organization’s main website and call a main number on the website, asking to be routed to the Accounts Receivables department.

- Confirm receipt of a test deposit of a nominal value prior to making a bank account change for the supplier, if necessary.

- Do not relax any security practices due to urgency by other parties — it’s better to slightly delay a payment than to send funds to a threat actor!

- Retrain all team members who deal with funds transfers on your company’s payment policies. During the training, alert team members to the likelihood of increased phishing attacks.

- Remind team members that attackers may impersonate a financial institution, a vendor, a business contact or a colleague (particularly executives and finance personnel).

Staying diligent and aware during this time is key to navigating these changes safely and successfully. If you should have any questions regarding the above, please reach out to your Altair Global representative for assistance.