ALTAIR ADVISOR: Exploring Cost Efficiencies through Stopping State Gross-ups in Non-conforming States

A Tale of Two Companies

Should Your Company Provide State Gross-Up for Non-Conforming States?

As a refresher for what defines a non-conforming state, here is some background on how that term came to be. The 2017 Tax Cuts and Jobs Act (TCJA) changed the rules for claiming the moving expense tax deduction. For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

Of the states with an income tax, about half automatically adopt all federal tax changes and must act legislatively to reject any or all of them. These states are commonly called “rolling” conformity states. The other half, commonly called “static” conformity states, have laws under which their tax code conforms to the federal code as of a specific date, which must be changed by new legislation to adopt federal changes. Three states either do not conform, or only conform selectively, and must also formally act to adopt any federal changes.

The following seven states continue to allow a deduction/exclusion for moving expenses:

- Arkansas

- California

- Hawaii

- Massachusetts

- New Jersey

- New York

- Pennsylvania

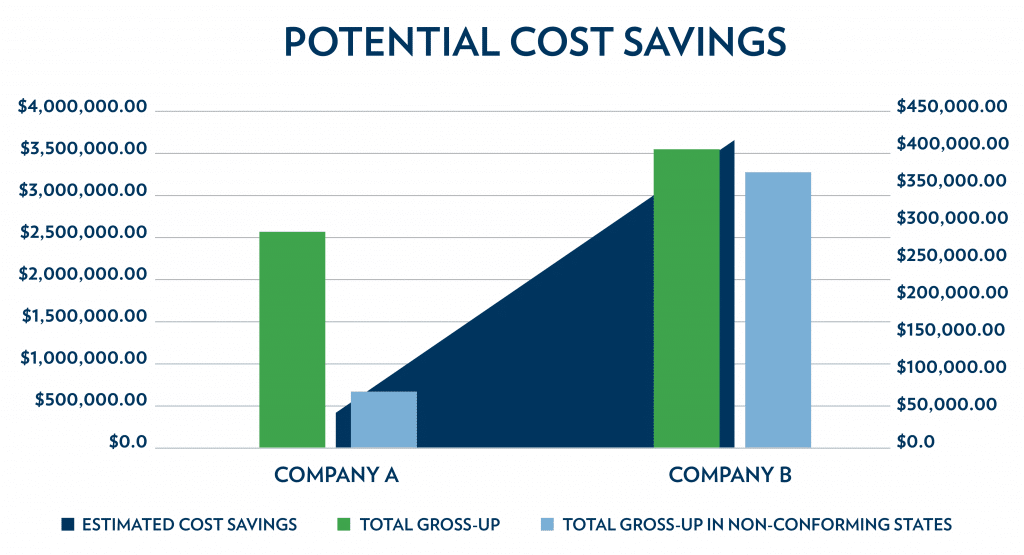

Due to the TCJA, your company is most likely providing gross-up for the now taxable moving expenses and you may be looking for avenues of savings to help offset the increased costs. Not providing state gross-up for moving costs for your relocations in the seven states noted above could be the answer. Let’s compare two companies, Company A and Company B, to see the potential cost savings for a twelve-month period.

For Company A, their relocations in non-conforming states for the given 12-month period made up almost 13% of their total relocations and almost 30% of their total gross-up. Not providing state gross-up in these non-conforming states could save them almost 2% in their total gross-up with an estimated savings of almost $50,000.00.

For Company B, their relocations in non-conforming states for the given 12-month period made up over 75% of their total relocations and over 90% of their total gross-up. Not providing state gross-up in these non-conforming states could save them almost 12% in their total gross-up with an estimated savings of over $400,000.00.

Of course, as with any change in policy, the potential savings will need to be weighed against your company’s tolerance for administrative and process changes as well as payroll system capabilities, but depending on the size of your program, they are definitely numbers worth thinking about.

If you have any questions on your current tax gross-up policies or how Altair Global can help you institute these type of savings, please reach out to your Client Services or Business Development representative.